open end loan examples

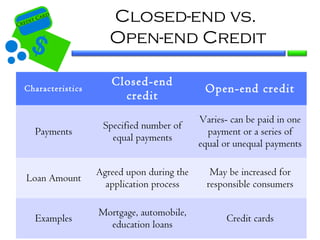

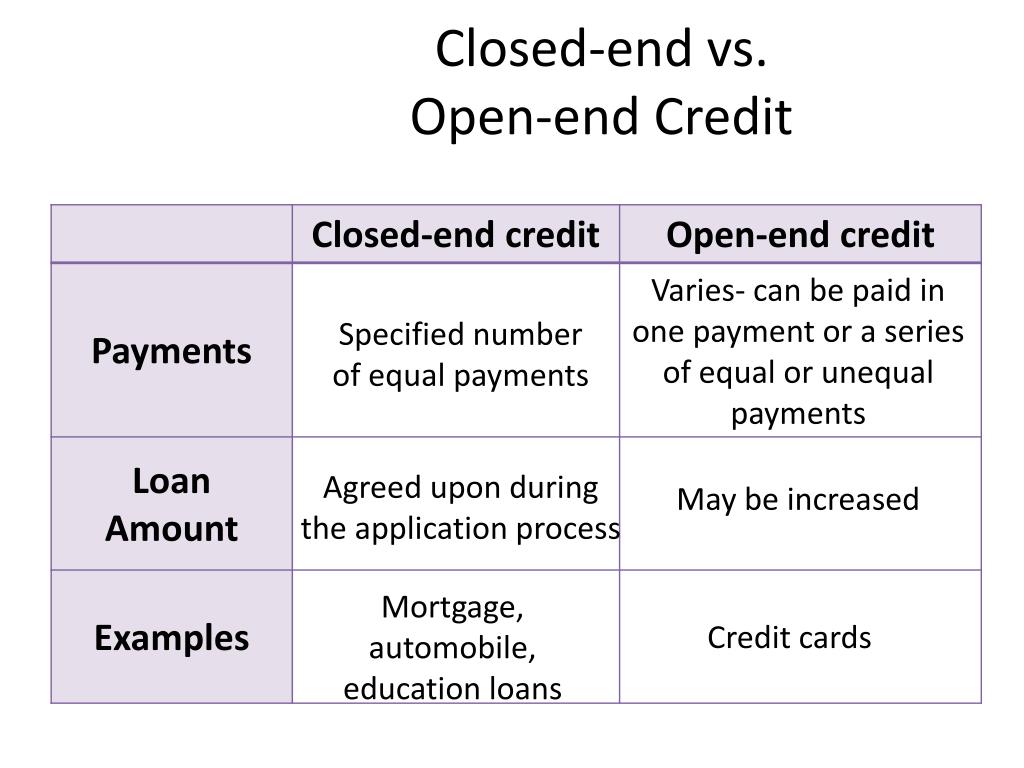

As mentioned earlier personal loans auto loans mortgages and student loans are examples of closed-end credit. Examples of open-ended loans include lines of credit and credit cards.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

Personal Loans Vs Credit Cards What S The Difference

Some examples of open-end credit loans are credit cards home equity lines of credit HELOC and a personal line of credit.

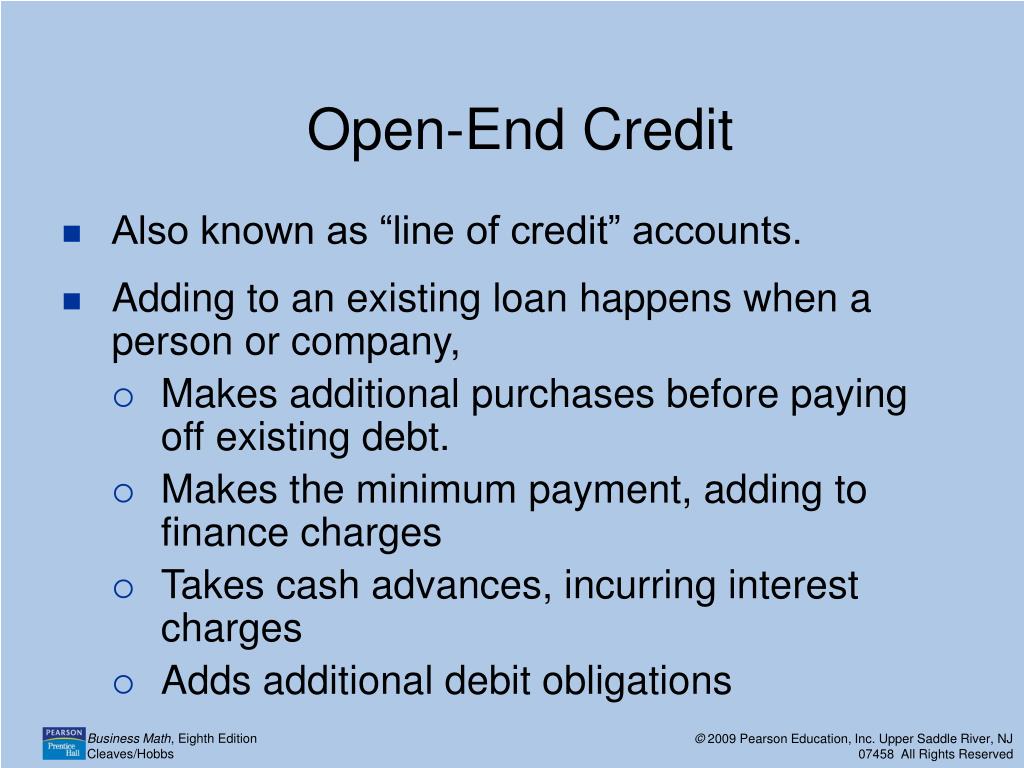

. Here are a few examples of loans that you might use at one time or another. An open-ended loan is a loan that does not have a definite end date. Common examples of open-end credit are credit cards and lines of credit.

Open-End Mortgage Example For example assume a borrower obtains a 400000 open-end mortgage to purchase a home. What are examples of open-ended loans. Closed end credit is a loan for a stated amount that must be repaid in full by a certain date.

A federal judge in Texas on Thursday blocked President Joe Bidens student-loan forgiveness plan which was already on hold after the 8th Circuit Court of Appeals issued a. An open-ended loan has no set expiration date. Until you take additional draws youll only make principal.

If any of the following terms is set forth in an advertisement the advertisement must include the additional disclosures described in D2. Borrowers benefit from open-end loan arrangements because they have more flexibility. An agreement between a.

Business line of credit. Payday loans are also an example of closed-end consumer. As you repay what youve borrowed you can draw from the credit line again and again.

Open-end credit refers to any type of loan where you can make repeated withdrawals and repayments. Most companies that offer open-end credit will check a FICO. Depending on the product.

The terms of open-ended loans may be determined by a. For example lets say youre buying a house for 300000 but you qualify for an open-end mortgage worth 400000. Service station credit cards.

Credit cards and a home equity line of credit or HELOC are examples of open-end loans. Personal line of credit. What are examples of open and.

One example of open end credit is credit cards. Types of Loans 1. Credit cards are the most common example of an open end loan in the consumer market because they provide flexible access to funds that are immediately available once a.

Lines of credit and credit cards are examples of open-ended loans. Home Equity Loans 7. The loan has a term of 30 years with a fixed interest.

Debt Consolidation Loans 2. Some of the most common examples of closed-end loans used today are home mortgages and auto loans. Other examples of open ended loans are.

Home equity loans 5. In each scenario the borrower will receive a loan that is equitable. Department store credit cards.

Balloon Mortgage Loans 8. Triggering Terms 102616 b.

The Top 9 Reasons To Get A Personal Loan Bankrate

Difference Between Open End Credit And Closed End Credit

Open End Mortgage Loan What Is It And How It Works

Ppt 12 1 Installment Loans And Closed End Credit Powerpoint Presentation Id 395602

Understanding Your Credit Card

Definition Closed End Credit Is Defined As Credit That Must Be Repaid In Advisoryhq

What Is An Open End Mortgage Supermoney

Free Loan Agreement Templates Pdf Word Legal Templates

:max_bytes(150000):strip_icc()/dotdash-how-can-i-tell-if-loan-uses-simple-or-compound-interest-Final-17d192dbebc1467cad0e73f776fa7ffd.jpg)

Simple Interest Vs Compound Interest

Staar Redesign Texas Education Agency

Solution Fp101 Phoenix Week 3 Consumer Credit And Scores Quiz Studypool

When Were Credit Cards Invented The History Of Credit Cards Forbes Advisor

Ppt Warm Up April 15 Tax Day Powerpoint Presentation Free Download Id 1763748

55 Open Ended Sales Questions To Qualify And Close More Leads

10 Types Of Loans Every Borrower Should Be Aware Of

Credit Basics Open Vs Closed Ended Credit Open Ended Credit Is Ongoing You Borrow You Repay You Borrow Again As Long As You Do Not Exceed Your Credit Ppt Download

Financial Services Unchained The Ongoing Rise Of Open Banking Mckinsey

:max_bytes(150000):strip_icc()/state-by-state-list-of-statute-of-limitations-on-debt-960881-Final-a906cc8bbdb640ee8acdb02c7e81377b.png)